Las Vegas 2025: Worst Home Sales Since 2007—But the Real Story is Even More Alarming

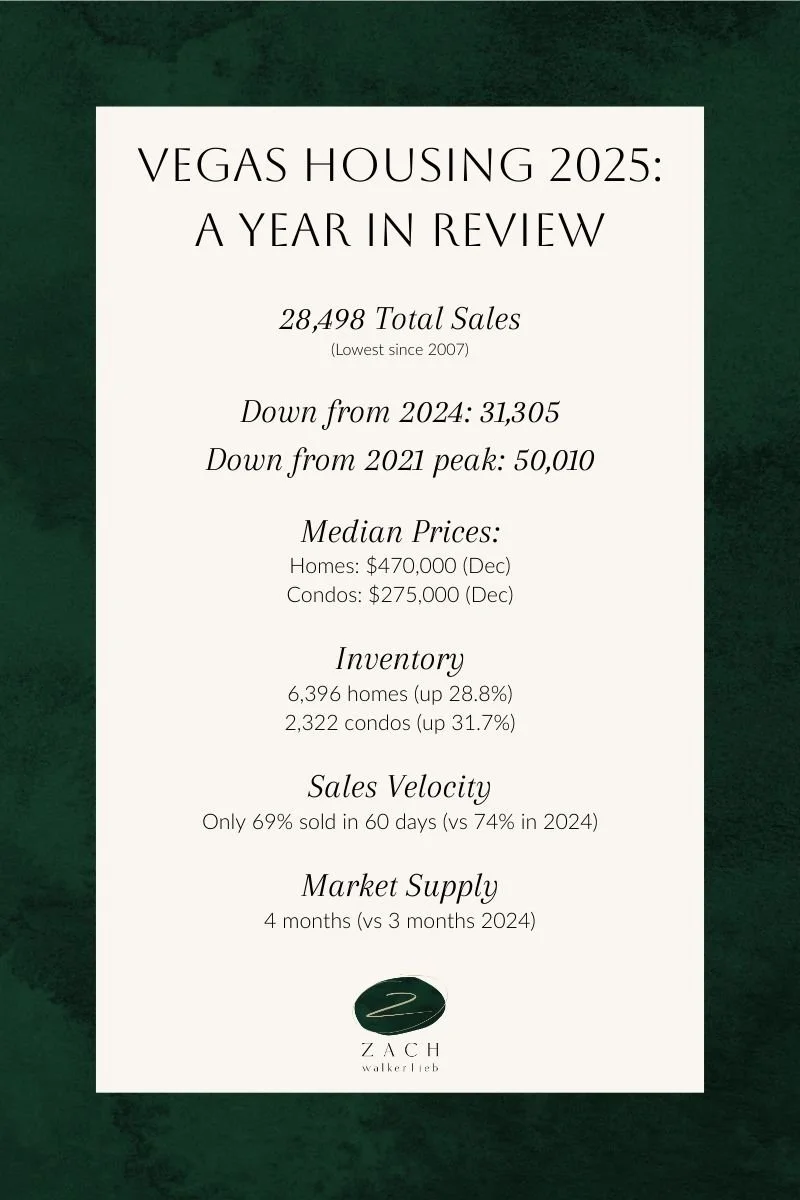

The headlines this week paint a concerning picture: Las Vegas home sales in 2025 hit their lowest level since 2007, with just 28,498 existing homes, condos, and townhomes sold throughout the year. That's down from 31,305 in 2024 and dramatically below the 2021 peak of 50,010 properties.

But according to local real estate expert Zach, the situation is actually far worse than these numbers suggest.

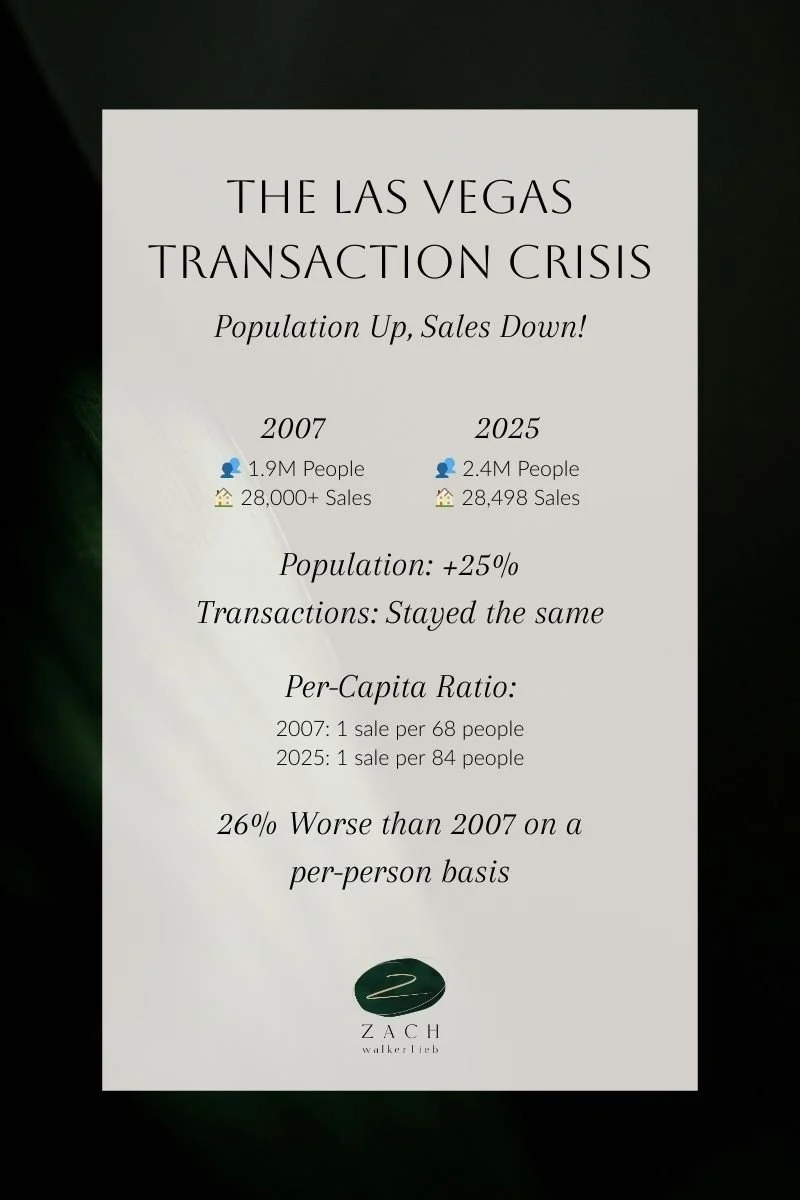

The Transaction Crisis Nobody's Talking About

"Not only are transaction volumes lower than in 2007," Zach explains, "the more important thing to note is that they're lower than 2007 and the population has increased by about 500,000 in Las Vegas."

Think about that for a moment. Clark County's population has grown from approximately 1.9-2.0 million in 2007 to over 2.4 million today—roughly a 25% increase. Yet we're selling fewer homes than we were 18 years ago.

"So on a ratio basis, it's actually far, far less transactions than what we should be seeing," Zach continues. "We are actually about 25-30% worse than we were in 2007 when talking about transaction volume.”

This is the real story the raw numbers don't tell: on a per-capita basis, Las Vegas real estate transactions have cratered to historically unprecedented lows.

What the Numbers Show

According to Las Vegas REALTORS' December report, the median price of existing single-family homes sold in Southern Nevada was $470,000, down 1.1% from December 2024 and down 3.9% from the all-time high of $488,995 set just one month earlier in November.

Condo and townhome prices fared even worse, with a median of $275,000—down 5.2% from December 2024 and well below the October 2024 peak of $315,000.

By year's end, inventory had climbed significantly:

6,396 single-family homes listed without offers (up 28.8% year-over-year)

2,322 condos and townhomes without offers (up 31.7% year-over-year)

Nearly four months of housing supply (versus three months a year earlier)

Sales velocity has slowed considerably. In December, only 69.2% of homes and 62.3% of condos sold within 60 days, compared to 74.5% and 75.8% respectively the previous year.

Why This Matters for Buyers and Sellers

The transaction crisis Zach identifies has profound implications for everyone in the Las Vegas real estate market.

For Sellers: You're facing the most challenging market in nearly two decades—not just in absolute terms, but relative to the size of the potential buyer pool. With double the population but fewer transactions than 2007, competition for buyers has never been fiercer.

This explains why inventory is climbing despite historically high prices. Properties that would have sold quickly in 2021-2022 now sit for weeks or months. Sellers who overprice or fail to properly stage and market their homes are getting left behind.

For Buyers: The good news is you have more negotiating power than you've had in years. The bad news is affordability remains a significant challenge, with median prices still near all-time highs even as the market cools.

But here's the thing: while transaction volume is historically low, this creates opportunity. Motivated sellers are increasingly willing to negotiate on price, cover closing costs, or make concessions they wouldn't have considered in peak market conditions.

For the Market Overall: This transaction freeze reflects a fundamental mismatch between where prices are and what buyers can afford. With mortgage rates that have come down to around 6% (much better than 2024's highs but still elevated by historical standards), many potential buyers remain on the sidelines.

Understanding the Lock-In Effect

Part of what's driving the transaction crisis is the "lock-in effect." Millions of Las Vegas homeowners refinanced at 3-4% during the pandemic. With current rates around 6%, there's little incentive to sell and buy another property at double the interest rate.

This creates a vicious cycle: fewer listings, less inventory turnover, reduced transaction volume—all while the population continues growing and housing demand theoretically should be increasing.

What's Different from 2007?

It's important to note that while transaction volume is lower than 2007, the causes are completely different.

In 2007, we were on the precipice of the housing crash. Las Vegas was ground zero for the subprime mortgage crisis, with speculation rampant, exotic financing everywhere, and a market built on unsustainable fundamentals.

Today's market problems stem from the opposite issue: too little financing availability (relative to demand), not too much. High rates have locked out buyers, not risky lending practices. And critically, distressed sales remain near historic lows at just 1.1% of transactions—versus the 60%+ we saw during the foreclosure crisis.

So while the transaction numbers are similarly dire, the underlying health of the market is fundamentally different.

The 2026 Outlook

Las Vegas REALTORS President George Kypreos struck an optimistic note in the December report: "Although it was a relatively slow year for home sales, we're seeing some encouraging signs heading into the new year. Buyer activity locally and nationally is starting to improve. Home prices have been fairly stable, and mortgage interest rates ended the year lower than they were the previous year."

And he's right that mortgage rates ending 2025 lower than they started provides some hope. The question is whether rates will drop enough to unlock the significant pent-up demand that clearly exists given our population growth.

Some encouraging signs:

Mortgage rates have stabilized around 6% after touching 7%+ in 2024

Inventory is increasing, giving buyers more options

Price corrections (like November to December) suggest the market is finding equilibrium

Economic fundamentals in Las Vegas remain relatively strong with ongoing major developments

But Zach's point about the per-capita transaction crisis suggests we're in a deeper funk than the raw numbers indicate. Even with rate improvements, are we going to see enough transaction growth to match our population expansion?

What Buyers Should Do

If you're in the market to buy in 2026:

Take Advantage of Leverage: With inventory up nearly 30% and sellers facing the weakest transaction market in decades, you have negotiating power. Don't be afraid to ask for concessions, repairs, or closing cost assistance.

Focus on Value: In a slow market, well-priced properties still move. Don't fall in love with overpriced listings expecting dramatic price drops—instead, identify homes priced fairly and negotiate from there.

Get Pre-Approved: Sellers in this market want serious buyers. Having financing ready makes you significantly more attractive than other potential buyers.

Consider Different Areas: With higher inventory across all neighborhoods, you may find opportunities in areas you hadn't previously considered.

What Sellers Need to Know

If you're thinking about listing in 2026:

Price Aggressively from Day One: The December data shows that properties are taking longer to sell. In this market, you can't afford to "test the market" with an inflated price. Work with a knowledgeable Las Vegas realtor to price competitively based on recent sales.

Understand You're Competing for a Smaller Buyer Pool: Zach's analysis makes this clear—relative to population, we have historically few active buyers. Your competition isn't just other listings; it's the fact that potential buyers have chosen to stay on the sidelines.

Make Your Property Stand Out: Professional photography, staging, repairs, and curb appeal matter more than ever. In a buyer's market, you need to give people reasons to choose YOUR home over the thousands of others available.

Be Flexible: Consider offering to pay closing costs, providing a home warranty, or making other concessions that reduce the buyer's out-of-pocket costs.

The Takeaway

The headline "Las Vegas 2025 Sales Hit Lowest Level Since 2007" is alarming enough. But Zach's analysis reveals the full picture: when you account for population growth, we're actually in a far more severe transaction crisis than the raw numbers suggest.

This isn't 2007—we're not facing a bubble popping or a wave of foreclosures. But we are experiencing a fundamental market dysfunction where supply and demand have disconnected due to affordability challenges and the lock-in effect.

For 2026, the key question is whether mortgage rates will drop enough and economic conditions will improve sufficiently to unlock some of the pent-up demand created by our growing population. Early signs are mixed, but with rates stabilizing and inventory increasing, the stage is set for potential improvement.

Whether you're buying, selling, or just watching the market, understanding the true depth of the transaction crisis—not just the absolute numbers, but the per-capita reality—is crucial for making informed decisions in the year ahead.

About the Author

Zach WalkerLieb is a top Las Vegas real estate agent and Managing Partner of Willow Manor, one of the city’s leading luxury real estate teams. With hundreds of millions in closed sales, Zach brings a deep, practical understanding of the Las Vegas housing market, from high-end luxury to everyday residential realities. Beyond real estate, he serves as Chairman of the Board for Habitat for Humanity and as a board member of Keystone Corporation, giving him firsthand insight into housing policy, affordability, and long-term community development. Known for clear thinking, market truth, and local expertise, Zach writes to help buyers, sellers, and investors make confident, well-informed decisions in Las Vegas real estate.

Working with a realtor who understands these market dynamics and can position you strategically—whether buying or selling—has never been more important. Want to discuss how the current transaction environment affects your specific situation? Reach out for a personalized market analysis.