The Mortgage Lock-In Effect: Why Las Vegas Homeowners Are Staying Put (And What It Means for You)

If you've been watching the Las Vegas housing market and wondering why there aren't more homes available, you're not alone. Despite inventory climbing over 30% in the past year, the market still feels frozen in many ways. The culprit? A phenomenon that's reshaping how Americans think about moving: the mortgage lock-in effect.

What Is the Mortgage Lock-In Effect?

The mortgage lock-in effect describes what happens when homeowners feel trapped by their ultra-low interest rates. If you purchased a home between 2012 and 2022, chances are you locked in a mortgage rate somewhere between 2% and 5%. Your monthly payment might be remarkably affordable—perhaps $1,500 for a home that would cost double that amount to buy today.

Here's the challenge: that same home, if purchased now, wouldn't just cost more due to price appreciation. You'd also be financing it at rates hovering around 6% to 6.5%, meaning your monthly payment could easily double. For many homeowners, that math simply doesn't make sense, even when they need more space, want to downsize, or are considering a move for work or family reasons.

According to recent data, 54% of U.S. homeowners wouldn't feel comfortable selling at any mortgage rate in 2025, up 12 percentage points from last year. Among those with rates below 3%, a striking 41% say they wouldn't consider buying again at any rate. The financial advantage of staying put has become too significant to ignore.

How the Lock-In Effect Has Transformed the Market

Before 2020, homeowners typically stayed in their homes for about 10 years. That timeline has now stretched to between 12 and 13 years on average. This shift has profound implications for housing inventory and market dynamics.

Research from the Federal Housing Finance Agency found that each percentage point of lock-in reduces a mortgage-bearing homeowner's probability of selling by 18%. When mortgage rates doubled from historic lows to 7% and 8% in 2022 and 2023, the impact was dramatic. Home sales plunged to levels not seen since the 2008 financial crisis, with transaction volume down to multi-decade lows.

In Las Vegas specifically, the effects are visible across the valley. While inventory has increased significantly—with over 7,500 single-family homes available as of fall 2025, up 30% to 40% year-over-year—sales activity remains subdued. Only 1,724 single-family homes sold in October 2025, down about 10% from the previous year. Homes are taking longer to sell too, with only 50% selling within 30 days compared to nearly 59% a year ago.

The Las Vegas Market: A Local Perspective

Las Vegas has experienced one of the most dramatic market shifts in the nation, ranking second nationally for the biggest swing from a seller's to a buyer's market. But the lock-in effect plays out differently across various neighborhoods and price points.

In Summerlin, where the median home price sits around $600,000 to $640,000, the market has shown remarkable price resilience. Inventory has grown, but premium positioning and strong fundamentals have helped maintain values. The master-planned community continues to attract move-up buyers and California transplants, though even here, buyers have regained negotiating power they lacked in 2022 and 2023.

Henderson tells a similar story, with median prices around $520,000. The area has seen inventory increases, particularly in the luxury segment around Lake Las Vegas and MacDonald Highlands, where sellers are increasingly offering concessions and price reductions to attract buyers. Days on market have extended considerably in these higher-end neighborhoods.

The starter home market presents a different picture entirely. Despite the overall inventory increase, entry-level properties remain highly competitive. North Las Vegas has seen inventory jump 42.9%, yet prices remain elevated due to first-time buyer competition. For those trying to break into the market, the lock-in effect on existing homeowners means fewer traditional starter homes are hitting the market.

Who Can Move—And Who's Beginning To

Not every homeowner is equally affected by the lock-in effect. Those who purchased homes in 2022, when rates were already climbing, are in a fundamentally different position than buyers from the 2020-2021 era.

Homeowners who bought in 2022 at rates around 6% to 8% don't face the same payment shock if they decide to move. As we move further from 2022—hitting the three, four, and five-year marks that often trigger moves—these homeowners represent a growing pool of potential sellers who aren't locked in by their mortgage rates. With current rates in the 6% to 6.5% range, some 2022 buyers might even find lower rates available than what they originally secured.

Additionally, life events continue to drive home sales regardless of interest rates. Career relocations, divorces, deaths, growing families, and empty nesters all create natural movement in the market. While the lock-in effect has slowed this churn, it hasn't stopped it entirely.

Recent data shows the share of mortgages with rates below 3% has declined to just over 20% of all outstanding mortgages—down from nearly 25% in early 2021. Meanwhile, the share of mortgages above 6% has climbed to nearly 20%, the highest level since 2015. This gradual rebalancing suggests the most extreme lock-in pressure may be beginning to ease, though the process will take years to fully unwind.

What This Means for Buyers

If you're looking to buy in Las Vegas right now, the market offers advantages that were unthinkable just a few years ago. Multiple offer situations have largely disappeared. Homes that once sold in days now sit for weeks or months, giving you time to conduct thorough inspections and negotiate repairs. In October 2025, buyers have choices—over 7,500 single-family homes and more than 2,600 condos and townhomes to consider.

Price reductions have become common, with nearly a quarter of listings seeing cuts. Seller concessions are back on the table. And while mortgage rates around 6% to 6.5% aren't the sub-3% rates of the pandemic era, they're historically normal and significantly lower than the 8% peaks seen earlier in the cycle.

The challenge is affordability. With median home prices around $470,000 for single-family homes and higher in desirable areas like Summerlin and Henderson, monthly payments still consume a significant portion of household income. But for those who can qualify, the reduced competition and increased inventory create a window that savvy buyers may look back on as optimal timing.

What This Means for Sellers

Selling in today's Las Vegas market requires a different strategy than it did in 2022 or 2023. Homes don't sell themselves anymore. Pricing to current market conditions—not to what your neighbor sold for two years ago—is essential. Professional staging, high-quality photography, and responsiveness to buyer requests all matter more than they have in years.

The good news? Homes are still selling. The fundamentals remain strong: Las Vegas continues to attract new residents, job growth supports demand, and Nevada's tax advantages make it appealing to relocating buyers. But success now requires meeting the market where it is, not where you wish it were.

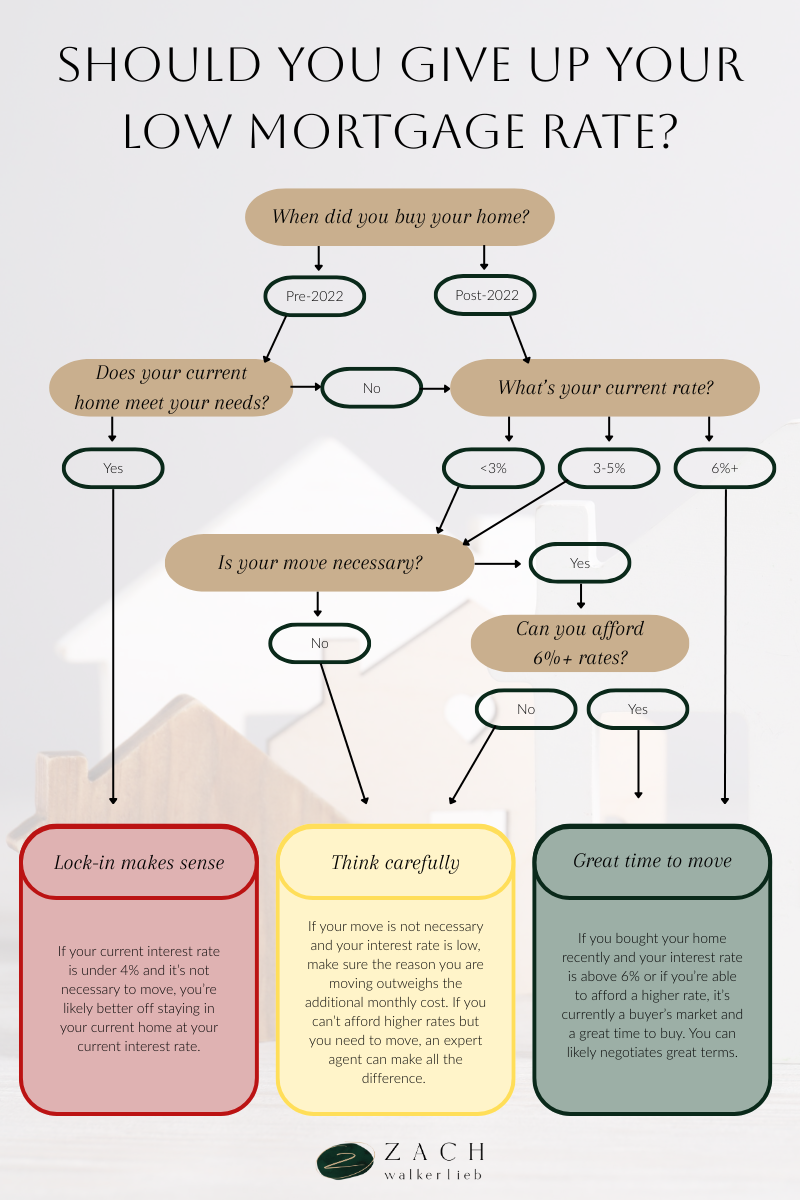

For those considering whether to sell despite a low mortgage rate, the calculation is deeply personal. If your current home no longer serves your needs, waiting years for rates to drop further may not be the best choice. The difference between a 3% and a 6% rate is significant, but so is living in the right home for your current stage of life.

Looking Ahead: Signs of a Thaw?

While the lock-in effect continues to shape the market, there are indications that conditions may gradually improve. Mortgage rates have stabilized in the 6% to 6.5% range after peaking near 8%. The share of homeowners with rates that no longer represent a massive discount is growing. And as each year passes since 2022, more households reach the typical 3-to-7-year window when moves become more common.

Some market observers believe 2026 could mark a turning point, with transaction volume potentially increasing in the second half of the year if rates drift into the mid-5% range. However, any recovery will likely be gradual rather than sudden. The lock-in effect has created years of pent-up demand and deferred mobility that will take time to work through the system.

For the Las Vegas market specifically, continued economic growth, major development projects like the A's ballpark and entertainment industry expansions, and ongoing migration from higher-cost states provide support for housing demand. The question isn't whether the market will thaw, but how quickly and what that will mean for prices and inventory levels.

Making Your Move in the Lock-In Era

Whether you're buying or selling in Las Vegas, understanding the lock-in effect helps you make more informed decisions. If you're a buyer, recognize that today's inventory levels and negotiating power represent a meaningful shift from the recent past. If you're a seller, accepting that the market has changed—and pricing and positioning accordingly—will determine your success.

The mortgage lock-in effect has fundamentally altered how the housing market operates, but it hasn't eliminated opportunity. For those navigating these waters, working with a knowledgeable Las Vegas realtor who understands both the broader trends and the nuances of specific neighborhoods like Summerlin and Henderson can make all the difference.

The market may feel frozen in some ways, but beneath the surface, it's adapting. And for those who understand the dynamics at play, there are still smart moves to be made—whether that means finding the right home with less competition, or positioning your property to stand out in a more selective buyer market.

Have questions about how the lock-in effect impacts your specific situation? Whether you're considering buying in Summerlin, selling in Henderson, or just trying to understand what comes next for Las Vegas real estate, Zach Walkerlieb brings the local expertise and market insight to help you navigate these complex decisions. Reach out today to discuss your real estate goals.