Mortgage Rates Hit 3-Year Low: What Summerlin and Vegas Luxury Buyers Need to Know

If you've been watching the Las Vegas real estate market and waiting for the right moment to make your move, this might be the news you've been hoping for. Mortgage rates just hit their lowest point in three years, and for those looking at luxury homes in Summerlin or anywhere in the Las Vegas valley, this could be a game-changing opportunity.

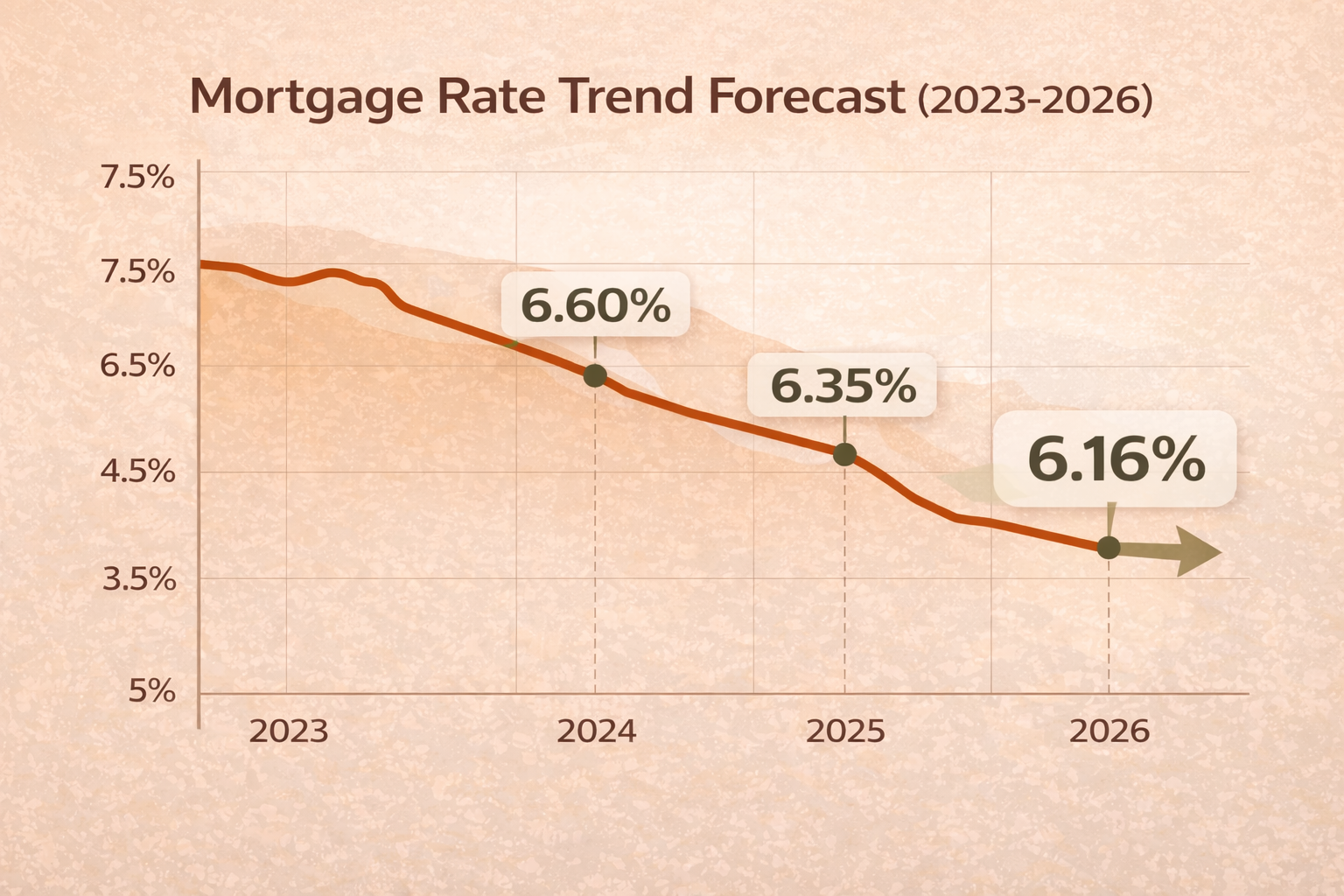

The Big News: Rates Drop to 6.16%

According to Freddie Mac's latest Primary Mortgage Market Survey, the 30-year fixed-rate mortgage averaged 6.16% for the week ending January 8, 2026. While that's a tiny uptick from the previous week's 6.15%, it's significantly lower than the 6.93% we saw this time last year.

Even better? The 15-year fixed-rate mortgage—popular among refinancers and buyers who want to build equity faster—averaged 5.46%, down from 6.14% a year ago.

"Mortgage rates are holding steady in a narrow range just above 6% as we enter 2026," said Sam Khater, chief economist at Freddie Mac. "With the economy continuing to expand and financing costs trending lower, we're seeing stronger housing demand—purchase loan applications are up more than 20% from a year ago."

What This Means for Las Vegas Luxury Buyers

As a Summerlin realtor who works with luxury buyers every day, I can tell you this: even a small rate drop makes a huge difference when you're looking at high-end properties.

Let's do the math. On a $1.5 million luxury home in The Ridges or MacDonald Highlands (pretty standard for premium Summerlin real estate), a one percentage point drop in your mortgage rate could save you approximately $1,200-$1,400 per month. Over the life of a 30-year loan, that's nearly $450,000 in savings.

Even with rates hovering around 6%, that's still considerably better than where we were 12-18 months ago when rates were pushing 7% and higher. For buyers who've been sitting on the sidelines waiting for affordability to improve, this is your window.

The Summerlin Advantage in Today's Market

Here's something the best Summerlin real estate agents will tell you: our local luxury market has been surprisingly resilient even during the higher-rate environment of 2024-2025. While some areas of the valley have seen price softening, premium neighborhoods in Summerlin—particularly guard-gated communities and custom home enclaves—have held their value remarkably well.

Why? Location, amenities, and the master-planned community lifestyle that Summerlin offers. When rates are favorable, luxury buyers who've been waiting tend to move quickly on their dream homes. We're already seeing increased activity from both local move-up buyers and out-of-state relocations.

If you're a luxury realtor serving Summerlin clients, you know that inventory in the high-end market can be limited. Lower rates mean more competition for those premier properties, so timing matters.

Refinancing Opportunities

The drop in rates isn't just good news for buyers—it's also creating opportunities for homeowners to refinance. The Mortgage Bankers Association reports that refinance applications are up 133% compared to last year, with refinancing now accounting for 56.6% of total mortgage applications.

For Summerlin homeowners who purchased or refinanced when rates were in the 7% range, shaving off even 0.75-1.0% could mean significant monthly savings. On a $1 million mortgage, dropping from 7% to 6% saves you about $650 per month—that's $7,800 annually.

Trump's $200 Billion Mortgage Bond Plan: An Extra Boost?

You may have also heard about President Trump's recent announcement directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds. This policy, which we covered in a recent blog post, is designed to push rates even lower by tightening the "mortgage spread."

Analysts predict this could drive rates down an additional 10-25 basis points (0.10%-0.25%), potentially bringing the 30-year fixed rate into the high 5% range. For luxury buyers in Summerlin or Henderson, every fraction of a percentage point counts when you're financing a high-dollar property.

While the full impact remains to be seen, the combination of naturally declining rates plus federal intervention creates a rare opportunity window for Vegas homebuyers.

What Experts Predict for 2026

Looking ahead, the Mortgage Bankers Association predicts rates will hover around 6.4% throughout 2026, while Fannie Mae's forecast is slightly more optimistic, projecting rates could fall to 5.9% by year's end.

Either way, we're likely looking at a relatively stable rate environment—which is actually good news for planning purposes. Whether you're a first-time buyer, a move-up buyer, or a luxury home shopper in Summerlin, you can make decisions with more confidence knowing rates probably aren't going to spike dramatically in the near term.

The Las Vegas Luxury Market Reality Check

Here's the straight talk from a luxury realtor who knows this market: lower rates don't solve every challenge. Las Vegas luxury inventory remains tight in the most desirable areas. Summerlin's guard-gated communities, custom home lots, and premium resale properties still move quickly when priced right.

What lower rates DO is expand your purchasing power and reduce your monthly carrying costs. For buyers who were stretching to afford their dream home at 7% rates, dropping to 6% or below makes those homes significantly more accessible.

For sellers in the luxury market, this is also good news. More qualified buyers with better financing options means potentially faster sales and less time on market—provided your property is priced competitively and shows well.

Strategic Moves for Today's Market

If you're considering buying or selling luxury real estate in Summerlin or anywhere in Las Vegas, here's my advice:

For Buyers: Don't wait for rates to drop another half-point. The difference between 6.16% and 5.75% is meaningful but not life-changing. What IS life-changing is finding the right property in the right location. Work with a Summerlin realtor who knows the luxury market inside and out, and when you find the home that checks all your boxes, be ready to move.

For Sellers: Price it right from the start. Even with favorable rates, buyers in the luxury segment are sophisticated and have options. Make sure your home shows impeccably and is positioned competitively within your neighborhood. The best Summerlin real estate agent can provide detailed market analysis to help you set the right price.

For Refinancers: Run the numbers with your lender. Factor in closing costs and how long you plan to stay in the home. If you can save $500+ per month and break even on costs within 24-36 months, refinancing probably makes sense.

The Bottom Line

Mortgage rates at three-year lows create real opportunities in the Las Vegas real estate market, especially for luxury buyers who've been waiting for the right moment. Whether you're eyeing a custom estate in The Summit Club, a golf course property in Red Rock Country Club, or a family home in the new Skye Summit development, financing conditions are as favorable as they've been in years.

The Summerlin luxury market remains strong, inventory is limited, and motivated sellers are pricing competitively. If you've been thinking about making a move, now is the time to get serious about your search.

As your trusted Las Vegas realtor specializing in Summerlin and luxury properties, I'm here to help you navigate this market with confidence. The combination of improved rates, strong local demand, and quality inventory creates a perfect storm of opportunity—but only for buyers and sellers who are ready to act.

About the Author

Zach WalkerLieb is a top Las Vegas real estate agent and Managing Partner of Willow Manor, one of the city’s leading luxury real estate teams. With hundreds of millions in closed sales, Zach brings a deep, practical understanding of the Las Vegas housing market, from high-end luxury to everyday residential realities. Beyond real estate, he serves as Chairman of the Board for Habitat for Humanity and as a board member of Keystone Corporation, giving him firsthand insight into housing policy, affordability, and long-term community development. Known for clear thinking, market truth, and local expertise, Zach writes to help buyers, sellers, and investors make confident, well-informed decisions in Las Vegas real estate.

Thinking about buying or selling luxury real estate in Summerlin? Let's talk about how these rate changes affect your specific situation and create a strategy that works for you.