Trump's $200 Billion Mortgage Bond Move: What It Means for Las Vegas Homebuyers

If you've been watching mortgage rates lately—and let's be honest, if you're in the Las Vegas housing market, you probably have been—you might have heard some buzz about President Trump's recent announcement to purchase $200 billion in mortgage bonds. As a Las Vegas realtor who talks to buyers and sellers every day, I wanted to break down what this actually means for our local market and whether you should get excited about potentially lower mortgage rates.

What's Actually Happening?

On Thursday, January 8th, President Trump announced he's directing Fannie Mae and Freddie Mac (the government-backed mortgage giants) to buy $200 billion in mortgage-backed securities. His goal? To push mortgage rates lower and make homeownership more affordable.

Here's the basic idea: When Fannie and Freddie buy more mortgage bonds, it increases demand for these securities, which can help push mortgage rates down. Think of it like any market—when there's more demand, prices go up, and in the bond world, when bond prices go up, the interest rates (yields) go down.

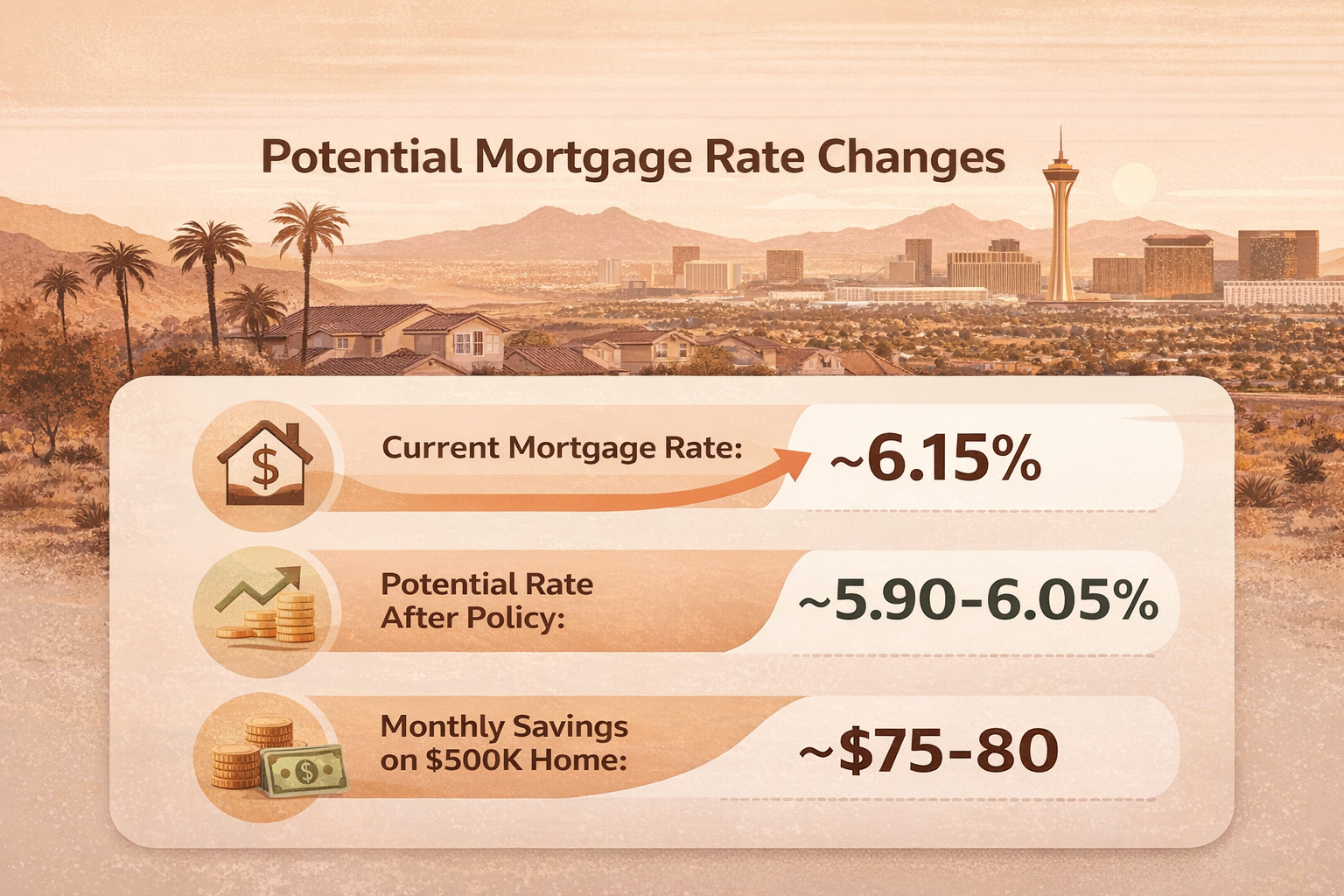

Right now, the average 30-year fixed mortgage rate is hovering around 6.15% to 6.33%. The administration's hope is that this $200 billion injection could nudge rates down closer to 6% or even into the high 5% range.

The "Mortgage Spread" Problem

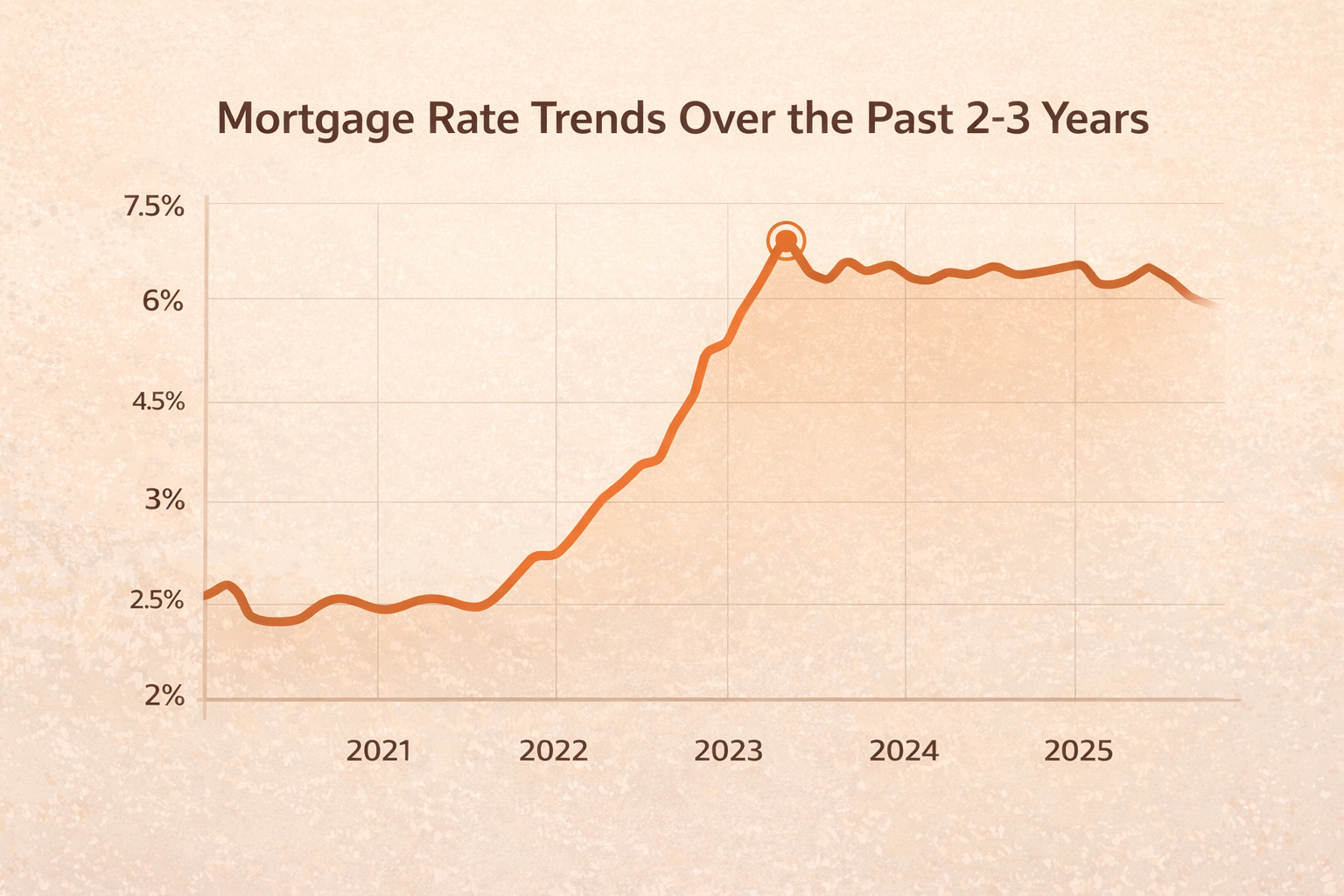

To understand why this matters, you need to know about something called the "mortgage spread." This is the difference between what you pay on your mortgage versus what the government pays on 10-year Treasury bonds. Historically, this spread has averaged about 1.76 percentage points.

But here's the thing: after the Federal Reserve stopped buying mortgage bonds in 2022, that spread ballooned to nearly 3 percentage points by mid-2023. That's a huge deal because it meant mortgage rates jumped way higher than they normally would have compared to other interest rates in the economy.

The good news? That spread has been slowly compressing and is now down to about 2.05 percentage points as of December 2025. Fannie and Freddie have actually already been buying mortgage bonds—they added about $69 billion in the second half of 2025 alone—which has helped bring rates down from the high 6% range to just above 6%.

Trump's announcement basically formalizes and supercharges what's already been happening.

So How Much Will Rates Actually Drop?

Here's where I need to give you the straight talk: most analysts expect the impact to be relatively modest. We're probably looking at mortgage rates dropping somewhere between 10 to 25 basis points (that's 0.10% to 0.25%). So instead of 6.15%, you might see rates around 6% or perhaps in the high 5% range if everything goes perfectly.

That's not nothing—on a $500,000 home (pretty standard here in Vegas), a 0.25% rate drop could save you around $75-80 per month, or about $27,000 over the life of a 30-year loan. But it's also not the dramatic game-changer some headlines might make it sound like.

The reason the impact is limited? The $200 billion purchase is relatively small in the context of the $9.26 trillion mortgage-backed securities market. Plus, there are concerns about whether Fannie and Freddie even have the capacity to make all these purchases—they're approaching their legal limits of $225 billion each in retained mortgage holdings.

We're probably looking at mortgage rates dropping somewhere between 10 to 25 basis points (that's 0.10% to 0.25%). So instead of 6.15%, you might see rates around 6% or perhaps in the high 5% range if everything goes perfectly.

What Does This Mean for Las Vegas Homebuyers?

As someone working in the Las Vegas real estate market, here's my take on how this could affect our local buyers and sellers:

For Buyers: Even a small rate drop is welcome news if you've been sitting on the sidelines waiting for affordability to improve. If rates do drop into the high 5% range, we could see more buyers jump back into the market, especially here in the valley where we've seen some price softening in 2025. Whether you're looking in Summerlin, Henderson, or North Las Vegas, lower rates make a real difference in your buying power.

For Sellers: Lower rates typically mean more buyer activity, which is good for inventory movement. However, there's a catch—if rates drop significantly, it could actually drive up competition and home prices again, especially in desirable areas like Summerlin or near master-planned communities. The best realtor in Summerlin will tell you that even small rate changes can shift buyer behavior quickly in premium neighborhoods.

The Supply Challenge: Here's the reality check: lower rates don't solve our housing supply problem. Las Vegas, like much of the country, is dealing with limited inventory. If rates drop and demand surges without enough homes to buy, prices could climb even higher, potentially offsetting the affordability gains from lower rates.

What About the Las Vegas Luxury Market?

If you're a luxury realtor or working with high-end buyers in areas like The Ridges, MacDonald Highlands, or Ascaya, this news might be less impactful for your clients. Luxury buyers often use different financing strategies, pay cash, or are less sensitive to small rate fluctuations. However, even in the luxury segment, lower rates could encourage move-up buyers who need to sell their current homes first.

The Bottom Line for Vegas Real Estate

President Trump's mortgage bond purchase directive could provide a modest boost to affordability, but it's not a silver bullet for the housing market. For Las Vegas homebuyers, here's what you should know:

Expect rates to potentially drop by 0.10% to 0.25%, which is helpful but not transformative

The impact will likely be short-term unless this becomes an ongoing program

Local market dynamics—like our ongoing development in Skye Summit, Cadence, and other master-planned communities—will continue to matter more than national policy

Supply constraints will remain the bigger challenge to affordability in Southern Nevada

My advice? If you're thinking about buying or selling in Las Vegas, don't wait around solely based on rate speculation. Yes, rates might tick down slightly, but they could also move back up if economic conditions change. Work with a knowledgeable Las Vegas realtor who understands both the national trends and our unique local market dynamics.

Whether you're a first-time buyer looking in North Las Vegas, a family moving up to Summerlin, or a luxury buyer searching for that perfect estate, the fundamentals haven't changed: location, timing, and being prepared to act when the right opportunity presents itself.

Stay informed, stay flexible, and remember—the best time to make a move in real estate is when it aligns with your personal and financial goals, not just when the headlines tell you to jump.

About the Author

Zach WalkerLieb is a top Las Vegas real estate agent and Managing Partner of Willow Manor, one of the city’s leading luxury real estate teams. With hundreds of millions in closed sales, Zach brings a deep, practical understanding of the Las Vegas housing market, from high-end luxury to everyday residential realities. Beyond real estate, he serves as Chairman of the Board for Habitat for Humanity and as a board member of Keystone Corporation, giving him firsthand insight into housing policy, affordability, and long-term community development. Known for clear thinking, market truth, and local expertise, Zach writes to help buyers, sellers, and investors make confident, well-informed decisions in Las Vegas real estate.

Questions about how national mortgage trends are affecting our local Las Vegas market? Reach out—I'm always here to help you navigate the ever-changing real estate landscape.